Topics and markets Q4/2024

Focusing on the right balance in the portfolio

![[Translate to English:] Dr._Goetz_Albert](/fileadmin/_processed_/9/e/csm_Dr._Goetz_Albert_1_b75c5b90f5.jpg)

After a strong year for equities in 2024, many investors are optimistic that markets will deliver further gains in 2025. However, opinions diverge on whether U.S. equities, despite their now ambitious valuations, will once again take the lead or whether European and Asian stocks will catch up. This question is well-founded, given the numerous uncertainties in the market – ranging from Europe's economic outlook to the specific impacts of the new Trump administration and the Federal Reserve's monetary policy trajectory. Investors are therefore well-advised to focus on a balanced mix of risk premia when performing their annual rebalancing. In addition to equities and bonds, they might wish to enhance their portfolios with alternative investment strategies offering attractive returns and diversification.

Yours

Dr. Götz Albert, CFA

Partner and Chief Investment Officer

USA vs. Europe: Quality in small-cap stocks is significantly higher in Europe

The U.S. stock market once again outperformed its European counterpart last year, primarily driven by the exceptional performance of a handful of technology stocks, the so-called "Magnificent 7." These companies deliver billion-dollar profits as well as spectacular growth rates, while many European blue chips represent the "old economy" with modest earnings growth.

However, the picture changes when focusing on small- & mid-cap stocks. While U.S. small and mid caps have recently outperformed their European peers, this development does not appear to rest on fundamental considerations. On the contrary: despite stronger economic growth in the U.S., many American small caps display weak fundamentals. For example, nearly 40% of companies in the Russell 2000 reported losses over the past 12 months, compared to just 7% in Europe. Significant advantages for European companies also exist with regards to earnings growth and financial solidity (see chart below).

This is surprising for two reasons: Firstly, U.S. companies rely heavily on their domestic market. Given the much higher GDP growth rates in the U.S. over recent years, the high number of unprofitable U.S. firms is striking. At the same time, European small and mid caps demonstrate remarkable resilience despite (geo-)political headwinds.

Secondly, the relative performance of the Russell 2000 does not align with current U.S. interest rate expectations. Futures markets are pricing in only minor rate cuts for 2025, reflecting stubborn inflation rates and the anticipation of further expansionary fiscal policies. This is likely to remain a headwind for the highly leveraged U.S. companies.

So, while U.S. small caps are primarily buoyed by hopes for relief under the new Trump administration, European small- and mid-cap investors can rely on solid fundamentals with attractive growth prospects based on analysts’ consensus.

Share of companies showing weak fundamentals (USA vs. Europe)

Data based on Russell 2000 and Stoxx Europe Mid 200 + Stoxx Europe Small 200, respectively. Losses based on diluted earnings from continuing operations. Annualized 5 year growth based on earnings before interest and taxes (EBIT). Source: Bloomberg, own calculations. As of: December 30th 2024.

Marcus Ratz

Partner, Portfolio Management Small & Mid Caps Europe

Gerald Rössel

CFA, Portfolio Management & Research Small & Mid Caps Europa

Convertible bonds offer risk-reduced exposure to crypto returns

The strong performance of cryptocurrencies last year reignited the debate among market participants about whether and to what extent this asset class should be included in strategic asset allocation. This discussion gained momentum from supportive signals from the new Trump administration, propelling the Bitcoin and crypto stocks to record highs with corresponding coverage in the financial news.

Less prominent in the media, but equally remarkable, are the ripple effects of these price developments on other segments of the market. For instance, U.S. companies with significant crypto exposure (or crypto-based business models) have increasingly turned to convertible bonds for refinancing. In the second half of 2024 alone, crypto-related firms issued convertible bonds totaling over USD 14 billion, accounting for more than 25% of the total U.S. issuance volume during that period.

The motivations of issuers vary widely, ranging from funding business expansion to pursuing more unconventional leverage strategies. One example for that is MicroStrategy: The software company used the proceeds from the convertible bond issuance to increase its Bitcoin holdings rather than to develop its software business. So far, this approach has been quite profitable due to Bitcoin’s price appreciation. However, the company’s stock increasingly behaves like a leveraged Bitcoin investment, with correspondingly high volatility.

While the convertible bonds linked to such stocks did not benefit to the same extent as the underlying equities from the crypto rally, they mitigated interim losses by approximately 50% (see chart). For risk-aware investors who do not want to entirely miss out on the opportunities of the crypto space, convertible bonds provide an effective way to participate in cryptocurrency returns while reducing the volatility of this highly fluctuating asset class.

MicroStrategy’s convertible bond and underlying stock in light of the strong Bitcoin in 2024

Convertible bond MSTR 0% 02/15/2027. Source: Bloomberg, own illustration. Observation period: February 24th 2021 (bond’s first trading day) until December 30th 2024. Past performance is not a reliable indicator for the future performance.

Marc-Alexander Knieß

Portfolio Management Global Convertible Bonds

Stefan Schauer

Portfolio Management Global Convertible Bonds

Manuel Zell

CESGA, Portfolio Management Global Convertible Bonds

Private Debt: Attractive yields come at a price

Investments beyond traditional capital market and banking products have grown increasingly popular in recent years, with private debt as an alternative form of credit financing benefiting significantly. The global assets under management in this segment have grown by over 15% annually since 20101, making it worthwhile to take a closer look at this asset class.

Even though there is no official definition, the term private debt generally refers to loans originated by investment firms or individual institutional investors rather than traditional banks. These loans target the so-called middle market which typically describes companies with annual revenues between USD 100 million and USD 1 billion, and that often lack a (high quality) credit rating.

Between 2018 and 2024, investments in private debt funds delivered impressive annual returns of over 8% which was more than double the returns on high-yield bonds.2 However, these yield premiums also reflect certain risks: higher default risks due to borrowers’ low credit quality (usually corresponding to a single B rating), lower liquidity as these loans are rarely traded on secondary markets, and reduced transparency compared to publicly traded bonds.

Moreover, since the end of ultra loose monetary policies, the credit spreads on private debt have declined significantly compared to previous years. In Europe, the average credit spread for this asset class was 768 basis points (bp) over the past five years, but it currently stands at just over 600 bp (see chart). The yield markup to the more liquid leveraged loans has also narrowed, which is surprising given the macroeconomic environment.

Therefore, investors should critically assess whether the current premia in private debt adequately compensate the additional risks taken with this asset class.

Norbert Adam

Portfolio Management Fixed Income Credit

Dr. Klaus Ripper

Portfolio Management Fixed Income Credit

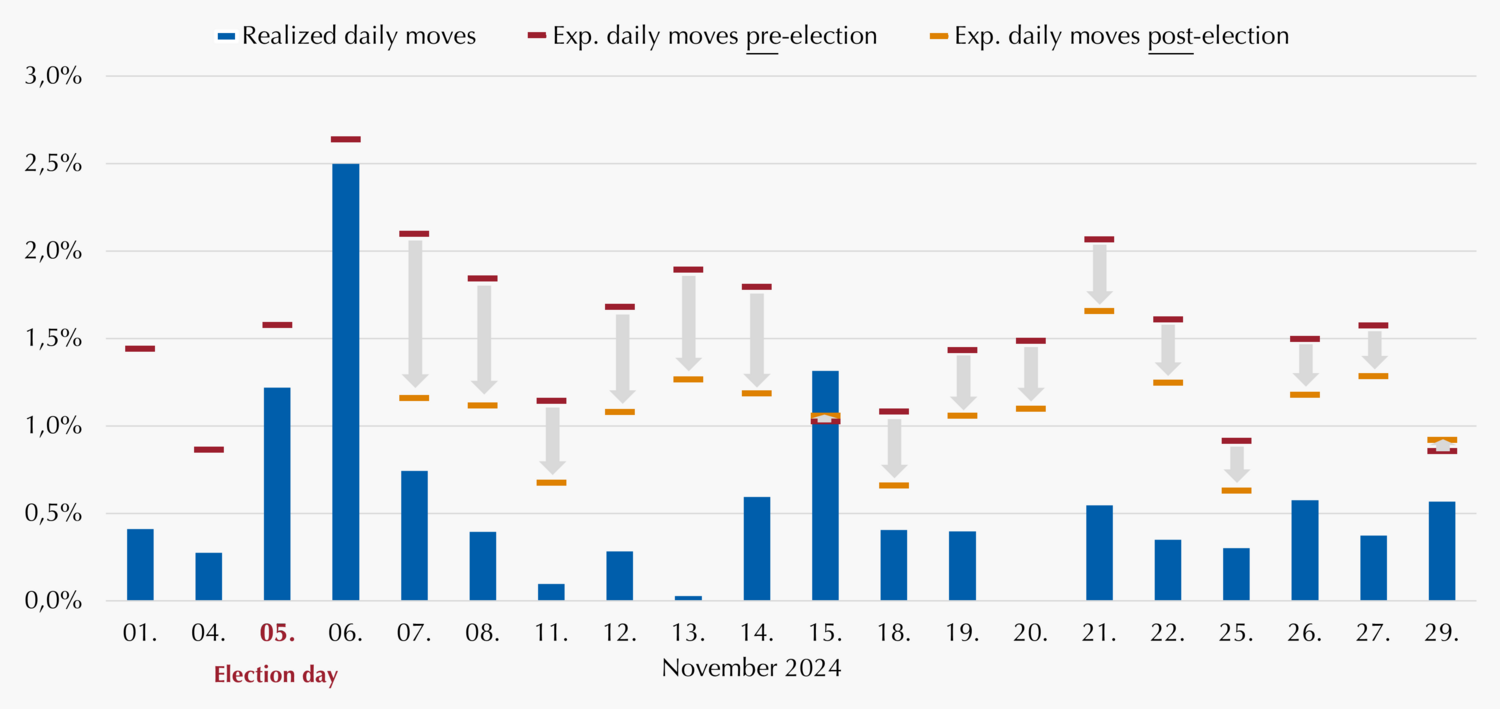

Expected and realized volatility – it’s the difference that matters

The eagerly awaited US presidential election last November perfectly illustrated the core mechanics of short-volatility strategies. Leading up to the election, markets were hopeful for a positive reaction in the event of a Trump victory. At the same time, there was notable nervousness about the potential consequences of a close result.

This sentiment mix was reflected in a significant increase in implied volatility, which, as measured by the VIX index, rose to around 23% by the end of October. As usually in light of major events, the “term structure” of implied volatility suggested that markets anticipated strong price movements for the day after election night.

Before the election outcome was confirmed, the market leaned towards a Trump victory, with the S&P 500 gaining while implied volatility remained at elevated levels. The following day, Trump’s victory led to a further rise in the S&P 500, accompanied by a sharp drop in the VIX. Clarity over the election result significantly reduced expectations for market swings in the days ahead.

Short-volatility strategy’s strong performance in election November was driven by two factors. First, the election results came in more distinctively than expected which led to a drop in implied volatility. In turn, this led to valuation gains on options that were previously sold at higher prices. Second, actual index movements throughout November (except for one day) were well below the daily swings that had been priced in beforehand (see chart), leading to a significantly positive implied-realized spread.

Thus, the US elections have impressively demonstrated that the success of short-volatility strategies does not depend on the absolute level of volatility but rather on the difference between expected and realized volatility. This highlights the attractive return potential of such strategies, even and especially in an environment marked by high uncertainty.

Implied and realized volatility during the US election in November 2024

Realized, absolute daily movements of the S&P 500 in November 2024 as well as implied daily movements based on term structure of implied volatility as per October 31st and November 6th, respectively. Source: Bloomberg, own illustration.

Mark Ritter

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander Raviol

Partner, CIO Derivative Solutions

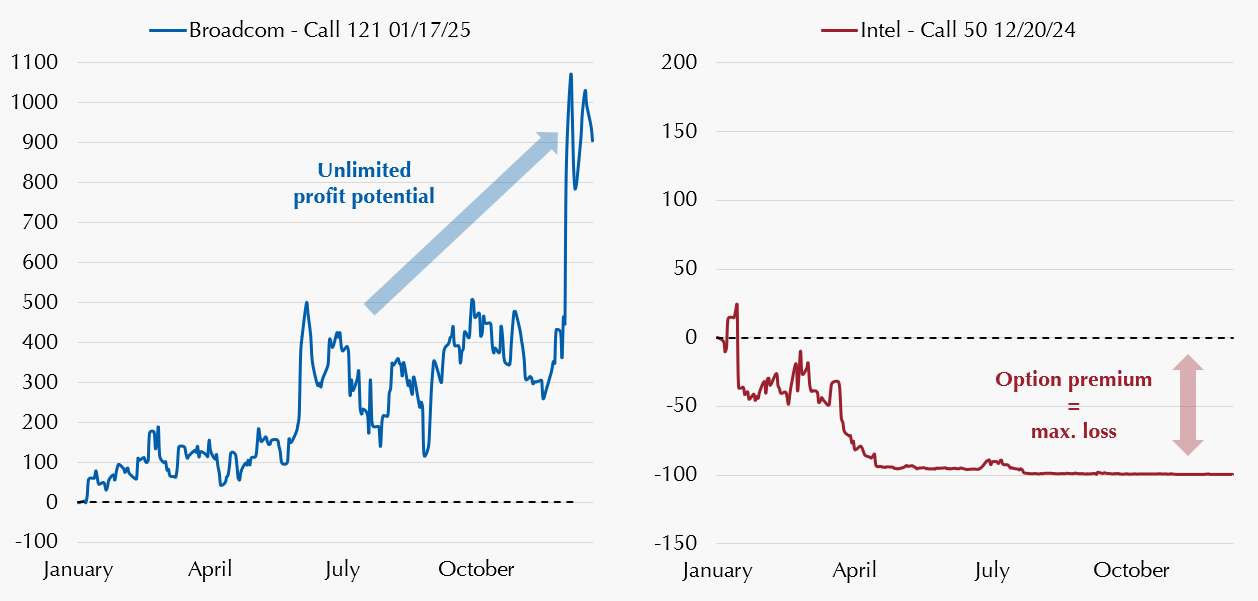

Option-based strategies benefit from performance divergence within the stock market

The year 2024 marked the second consecutive year of roughly 20% returns in global equity markets. The "Magnificent 7" have driven capitalization-weighted stock indices to record highs, while equal-weighted indices delivered only half the performance. This has resulted in significant performance divergence among individual stocks: a few have posted triple-digit annual returns, while many others have traded sideways.

This market concentration worries many investors, yet they are equally reluctant to miss out on further potential gains. Consequently, equity-focused capital protection strategies have gained popularity. Interestingly, option-based value protection strategies have emerged as key beneficiaries of performance divergence for two main reasons:

Firstly, the low (expected) correlation between stocks – reflected in high divergence of price performance – results in reduced volatility at the aggregate index level. This lowers premiums on index options, which in turn benefits options-based strategies (see also issue Q1/2024).

Secondly, option strategies can capitalize on high divergence at the individual stock level, as demonstrated in the following example. Share prices of chipmakers Broadcom and Intel showed opposing trends last year. Investors who held positions in both stocks realized gains from Broadcom as well as losses from Intel. In contrast, by establishing call positions on the stocks, they could benefit from Broadcom's strong performance while only losing the relatively low call premium on Intel (see chart).

For investors who wish to mitigate drawdown risks, while retaining performance potential, options-based equity protection strategies with convex payoff profiles offer an effective solution. These strategies reduce risks while preserving the potential for attractive returns.

Stephan Steiger

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander Raviol

Partner, CIO Derivative Solutions

Module-based overlay provides an efficient portfolio solution for any market environment

The promise to manage risks while preserving the return potential of capital markets is a hallmark of nearly all hedging strategy providers. Yet, many fail to deliver: some strategies fall short of providing the promised downside protection, while others successfully hedge but miss the

(re-)entry into rising markets or are simply too cost-intensive.

Failing to participate adequately in recovery phase is often observed with traditional value protection strategies with a hard floor. After successfully hedging the downside, these strategies often fall into a "cash-lock" that can only be resolved with additional risk capital allocated by investors.

However, by employing a portfolio overlay consisting of various modules, it is possible to combine drawdown protection with the avoidance of cash-locks. These modules address diverse overlay requirements while reducing costs.

Concretely, the payout profiles of hedging options can be cost-efficiently replicated using futures and credit default swaps. This approach mitigates drawdowns of varying magnitudes and durations effectively.

For rare but significant overnight market moves with severe losses, tail hedges provide immediate response to sudden changes. For example, in scenarios where sharp losses occur across asset classes, short-term drawdowns can be limited effectively with calls on volatility indices (see Q3/2024).

Despite a cost-efficient implementation, any overlay incurs hedging costs during positive market phases. However, by taking on limited additional risk, the positive trend of the capital markets – and that of the investor’s portfolio – can be reinforced, offsetting the costs for hedging over the long term. The market delta increases "automatically" (without market timing of a portfolio manager) in rising markets, ensuring that investors are able to capture the return potential of their strategic asset allocation during non-crisis periods.

Marvin Labod

Head of Quantitative Analysis

Alexander Raviol

Partner, CIO Derivative Solutions