![[Translate to English:] Absolute Return Studie [Translate to English:] Absolute Return Studie](/fileadmin/_processed_/7/1/csm_Vola-Studie_8039834ee7.jpg)

Liquid alternatives in the first half of 2024: investors drawn to specialised fixed-income strategies

The recent increased withdrawal from absolute return and liquid alternatives funds has slowed noticeably. While net outflows reached EUR 35.1 billion in 2023 as a result of the turnaround in interest rates, they were only a moderate EUR 6.37 billion in the middle of the year, with outflows decreasing from one month to the next. Fixed-income strategies were the main focus of investors in the first half of the year, recording the largest net inflows (EUR 2.2 billion). Overall, volumes in the asset class decreased by 3.1% overall to EUR 224.4 billion.

With an average fund performance of 4.71%, liquid alternative strategies outperformed unregulated hedge funds (4.08%). Liquid alternatives also significantly outperformed European corporate bonds (0.44%) and European government bonds (-2.13%), which suffered due to unfulfilled expectations that central banks would make several rate cuts.

Across all strategies, the evaluated funds kept their risks well under control in the first half of the year, with an average maximum loss of 3.6%. The longer-term view also confirms that investors in this asset class will be spared excessively painful drawdowns if they carry out careful due diligence, with nearly three-quarters of all funds successfully limiting their maximum losses to less than 20% over five years.

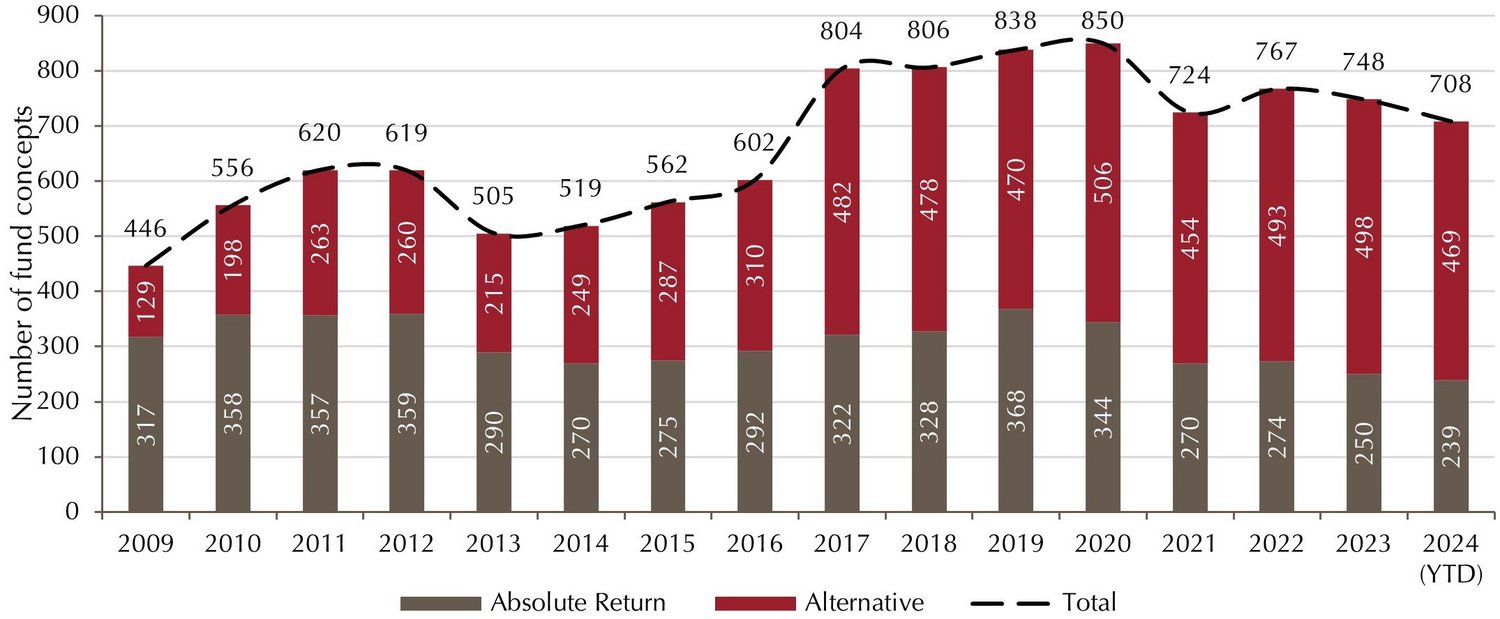

Number of funds declines slightly

The number of funds grouped together in the evaluated segment fell by 40 to 708 compared with the end of 2023 (-5.4%). This decline is evident among both absolute return (-4.4%) and alternative concepts (-5.8%), with the ratio of two-thirds alternatives to one-third absolute return remaining unchanged.

Decline in market volume flattens out

The market volume of liquid alternatives fell in the first half of 2024, with funds managing a total of EUR 224.4 billion, around EUR 7.2 billion* (3.1%) less than at the end of the previous year. This means that liquid alternative strategies have lost around 20% of their volume compared to their 2019 peak. The growth phase for this asset class from 2009 to 2019 was mainly dominated by a low interest rate environment that prompted investors to look for alternative sources of return. Volumes then stagnated and even declined with the turnaround in interest rates. The two fixed-income strategies alone once again recorded significant net inflows in the first half of the year (table, p. 4; chart, p. 5).

* Outflows from this asset class totalled EUR 6.4 billion (p. 4). While performance was positive at 4.72% (p. 7), the increased decline in market volume was the result of funds that were newly added to or removed from the universe.

Fixed-income strategies maintain their market share

The five largest strategies account for around three-quarters of the total market volume of liquid alternatives strategies, with the two fixed-income strategies – Absolute Return Bond and Alternative Credit Focus – representing almost 30% of the entire market. Alternative Multi Strategies extended their lead slightly once again despite recording more significant outflows (p. 4) towards the end of 2023 (18.9%) to remain the largest individual strategy at 19.4%.

The three largest strategies are responsible for half of all assets

Liquid alternatives assert their position between equities and bonds

Liquid alternatives strategies are also consolidating their long-term position between equities and bonds, underscoring their suitability as a diversifying element within a portfolio. While many bonds have still not recovered losses that in some cases reached double digits during the turnaround in interest rates in 2022 and threaten to record another year of losses in 2024, liquid alternative strategies were able to demonstrate that they can hold their own even in a challenging market environment.

Liquid alternatives exhibit solid long-term return

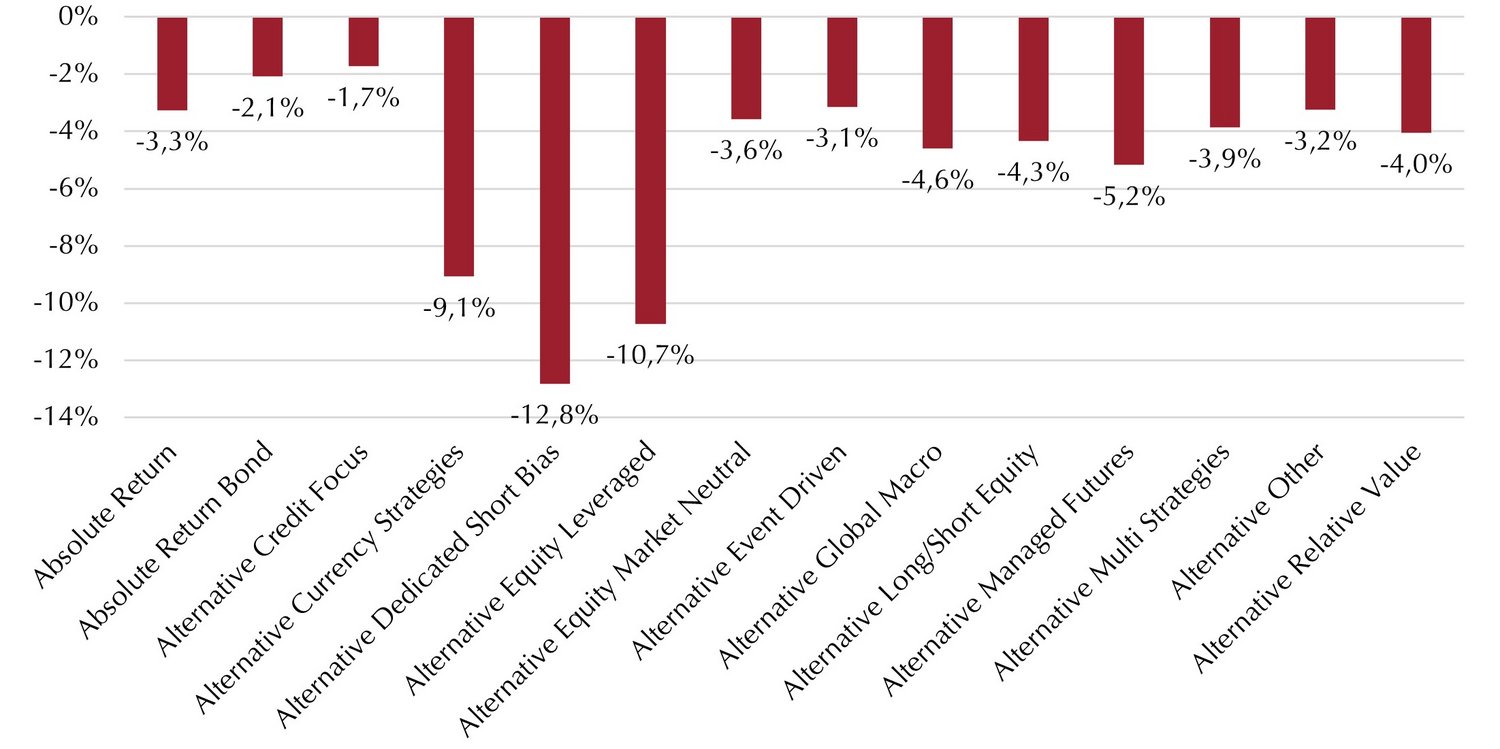

Maximum losses remain within narrow limits

The average maximum loss across all strategies was a moderate 3.6% in the first half of the year. At strategy level, both fixed-income strategies – Absolute Return Bond and Alternative Credit Focus – experienced the lowest drawdowns on an annual basis. At fund level, nine of the ten funds with the lowest maximum losses came from fixed-income strategies, with most of these taking the form of structured credit or CLO funds. The three strategies with the highest losses were leveraged strategies, which reported larger drawdowns per construction, as well as Alternative Currency strategies, which include crypto funds that caused major fluctuations.

2024: Average maximum drawdown per strategy

Long-term comparison: high maximum losses jeopardise overall return

The following chart shows the returns generated by individual funds over five years in relation to their maximum losses. Each point corresponds to a fund that has already been in the segment for at least five years. Most of these funds – more than 74% – are situated in column I on the left. They can limit their maximum losses to no more than 20%, with the vast majority recording a positive performance. As shown in columns II to V, the higher a fund’s risk tolerance is, the more pronounced the positive and negative return outliers are. However, the majority of funds in columns III, IV and V were no longer able to recover from their high maximum losses, with drawdowns of 40% or more seemingly difficult, if not impossible, to offset in this segment. When carrying out their due diligence, investors should therefore pay particular attention to risk management and the instruments used to limit losses. However, the aim here is not to avoid losses as far as possible, because this is expensive and eliminates not only risk but also any opportunity to generate returns.

Disclaimer: Es handelt sich hierbei um eine Studie zu allgemeinen Informationszwecken und nicht um ein investmentrechtliches Pflichtdokument. Die dargestellten Informationen stellen keine Kauf- oder Verkaufsaufforderung oder Anlageberatung dar. Sie enthalten nicht alle für wirtschaftlich bedeutende Entscheidungen wesentlichen Angaben und können von Informationen und Einschätzungen anderer Quellen/Marktteilnehmer/Studien abweichen. Für die Richtigkeit, Vollständigkeit oder Aktualität dieser Studie wird keine Gewähr übernommen. Sämtliche Ausführungen gehen von unserer Beurteilung der gegenwärtigen Rechts- und Steuerlage aus. Alle Meinungsaussagen geben die aktuelle Einschätzung der Gesellschaft wieder und können ohne vorherige Ankündigung geändert werden.

Lupus alpha Investment GmbH

Speicherstraße 49–51

D-60327 Frankfurt am Main