Topics and Markets Q2/2024

"The one thing that's certain is that nothing is certain. Even that isn’t certain." (Joachim Ringelnatz)

![[Translate to English:] Dr._Goetz_Albert](/fileadmin/_processed_/9/e/csm_Dr._Goetz_Albert_1_b75c5b90f5.jpg)

The stock markets are firmly committed to the desired scenario of falling interest rates. The MSCI World, for example, has risen 30% since the end of October, when hopes for interest rate cuts emerged. Equity markets have a good chance to continue to rise – if U.S. and Eurozone interest rates actually fall in the coming months. There is no certainty in such forecasts, especially as equity markets have already made a strong advance in anticipation of the positive impact of low interest rates on companies and corporate profits. In the spirit of Joachim Ringelnatz, investors should therefore diversify their portfolio and integrate investment strategies beyond traditional concepts.

Yours,

Dr. Götz Albert

Partner and Chief Investment Officer

Corporate buyers take advantage of low valuations

Much has already been reported in recent months about the low valuations in the European small- and mid-cap equity segment. While a broad-based rally in the segment is taking a long time, private equity (PE) firms are taking advantage of the current reluctance by buying listed companies at cheap prices. Examples include the PE acquisitions of the UK cyber firm Darktrace and the advisory firm Alpha Financial Markets Consulting from the micro caps segment.

In the small- and mid-caps space, in particular, an increasing number of acquisitions by other, larger competitors or PE companies can be observed. In view of the still relatively high interest rates, the increased M&A activity is not due to favourable financing opportunities, but rather to the historically low valuations in the small- and mid-caps universe.

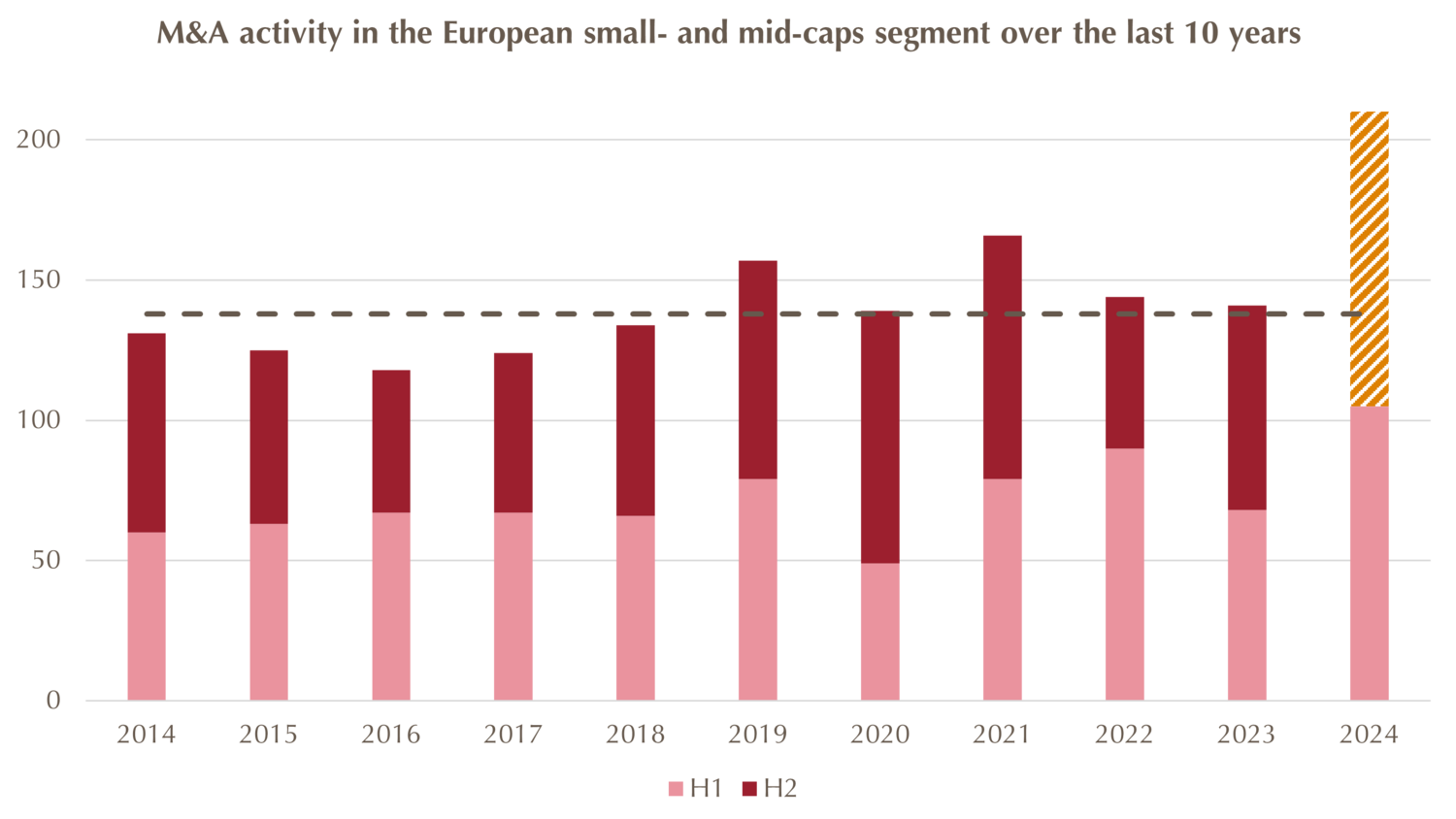

Looking at the history of takeovers and acquisitions over the past 10 years in the European small- and mid-caps segment, these were at a relatively constant level (see chart below). However, in the current year, the number of announced transactions at the mid-point of the year is already at 70% of the full-year average for the last 10 years and 40% above the average for the first half of the year.

It should be noted that acquisitions generally take place at a significant valuation premium. This is often in the mid-double-digit percentage range, which underscores that buyers consider the target companies to be severely undervalued. While competitors are willing to pay these premiums because they expect additional synergy effects in addition to the acquired company value, PE companies are almost exclusively focused on yield considerations. This suggests that PE companies see further upside potential despite premiums of up to 100% (!).

Past performances are no guarantee of future performance. Expectation for H2/2024 based on extrapolation of data for H1/2024. Source: Bloomberg M&A monitor. Filters: Date (Announcement Date); Status (Announced, pending, completed); Type (PE, Majority Purchase, Company Takeover); Region (Western Europe); Target (Public); Size ($50 million-10 billion). As of: 30 June 2024

Marcus

Ratz

Partner, Portfolio Management Small & Mid Caps Europe

Jonas

Liegl

CFA, Portfolio Management Small & Mid Caps Europa

Refinancing benefits of convertible bonds also provide opportunities for investors

The primary market for convertible bonds remains active in the second quarter, reaching the highest level for global issuance volumes since 2021. With a $ 5 billion convertible bond issued by Alibaba, one of the largest convertible bonds in history was printed in May. This pick-up in primary market activity is due to the fact that many companies need to refinance their expiring financings (“maturity wall”) as cheaply as possible. But what exactly are the savings from lower coupons that issuers pay for by a potential dilution of their equity (in case investors exercise the options)?

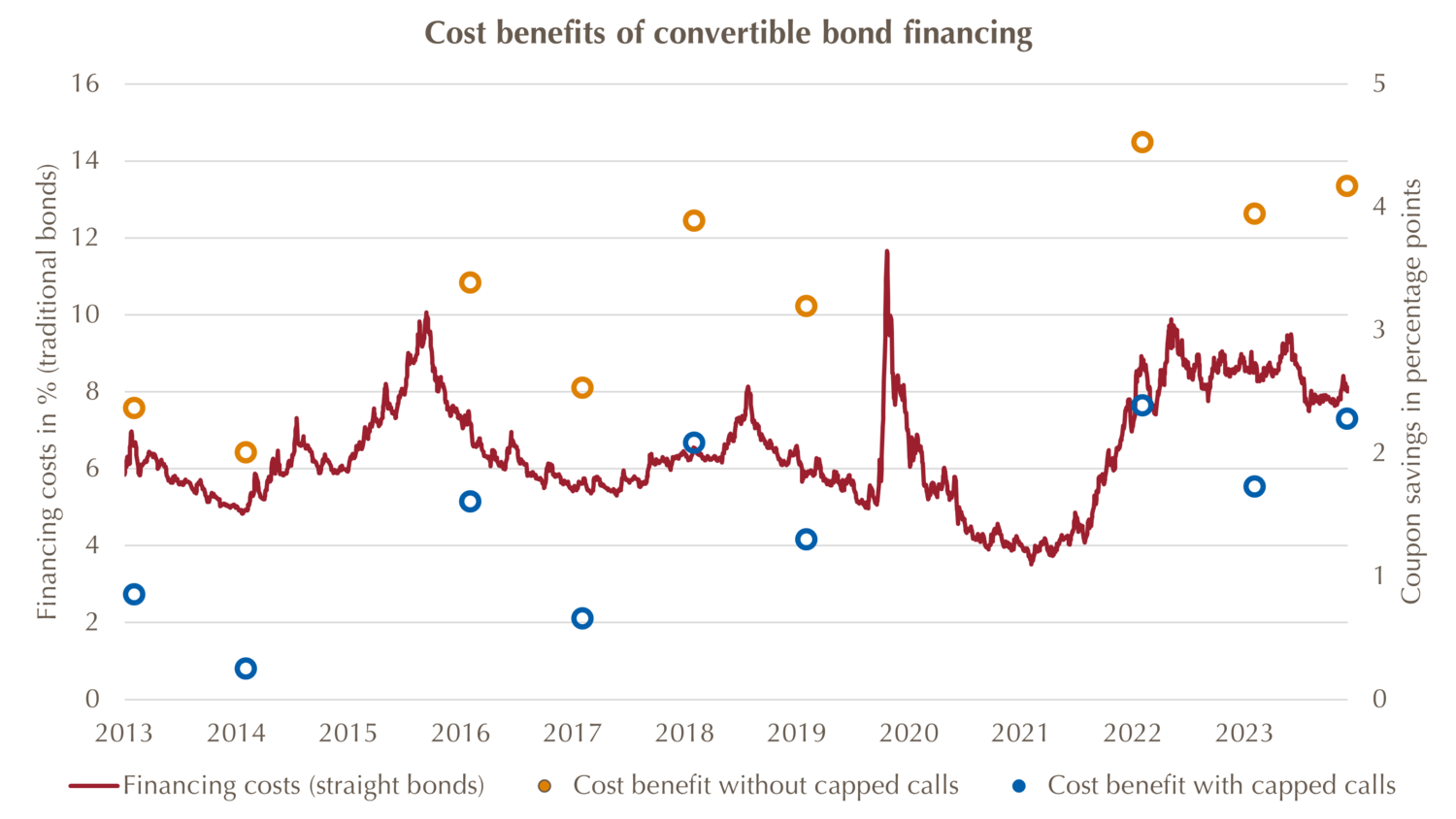

According to an analysis by Bank of America on the U.S. market over the last 10 years, companies with convertible bonds save interest costs averaging 3.2 percentage points per annum over traditional debt. The higher the general interest rate level, the higher the cost savings. As markets still wait for interest rate cuts in the U.S., savings in the current year are even estimated to be around 4.2 percentage points. These refinancing benefits seem to be so attractive to many companies that they accept the risk of diluted equity.

However, a closer look reveals that many issuers use so-called capped calls to try to contain the dilution effects that would occur if options were exercised in light of rising stock prices. Essentially, they buy call options and thus the right to acquire their own shares, thereby reducing the net effect on the number of outstanding shares.

The refinancing benefits are of interest not only to issuers but also to investors. This is because the increased issuance activity leads to a significantly higher number of companies becoming active in the convertible bond segment for the first time, which in turn means a larger universe for investors to pick from.

Marc-Alexander

Knieß

Portfolio Management Global Convertible Bonds

Stefan

Schauer

Portfolio Management Global Convertible Bonds

Manuel

Zell

CESGA, Portfolio Management Global Convertible Bonds

Security of structured products: A diversified asset base matters

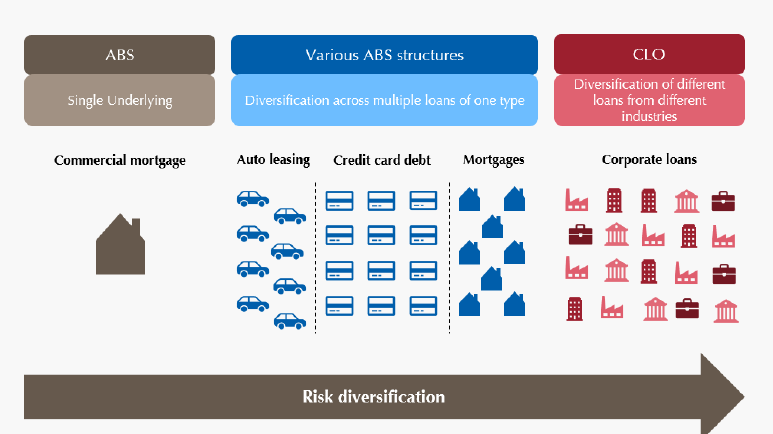

In the first quarter report, we have already mentioned the risks in the commercial real estate market. Those are particularly visible in the metropolitan regions as some investors in a commercial mortgage-backed security (CMBS) in the U.S. have now had to learn. There, the default of a mortgage on the office building 1740 Broadway in New York City resulted in massive losses for investors. But why did this one building play such a big role? Well, the ABS structure in question was only secured by that one mortgage. The decline in the value of the mortgage therefore had such a dramatic effect that not only investors in the subordinated tranches took losses, but even investors in the AAA tranche.

Although the example is certainly one of a few extreme cases, it shows the high relevance of a diversified asset base of ABS structures. When selecting structured products (or funds for the same), investors should always keep an eye on the underlying they contain. The resilience of tranches with the highest credit rating of a waterfall structure is largely determined by its underlying loans. While there are examples of a very concentrated risk base in the MBS segment, the number of loans in auto ABS (leasing receivables), credit card ABS (credit card receivables) and CLOs (corporate loans) are significantly higher (generally more than 100 loans). Only due to the multitude of loans, the waterfall structure can show its true strength and protect investors in the upper tranches from losses.

Furthermore, in the case of CLOs, the underlying loans are senior secured and issued by medium-sized and large companies – ranging from luxury watch manufacturers to pharmaceutical companies. This provides an additional safety margin to CLO structures, as the underlying loans and their collateralisation lead to the broadest possible sectoral diversification.

Dr.

Klaus

Ripper

Portfolio Management Fixed Income Credit

Norbert

Adam

Portfolio Management Fixed Income Credit

Making efficient use of existing fixed income portfolios by adding volatility overlays

The rise in interest rates has prompted investors to expand their fixed income holdings as they once again offer higher returns at presumably low risk. However, as has been shown in recent years, bonds are not immune to losses either. High duration losses as well as the currently reduced risk premiums (spreads) have again clearly highlighted the need for further building blocks diversifying the portfolio.

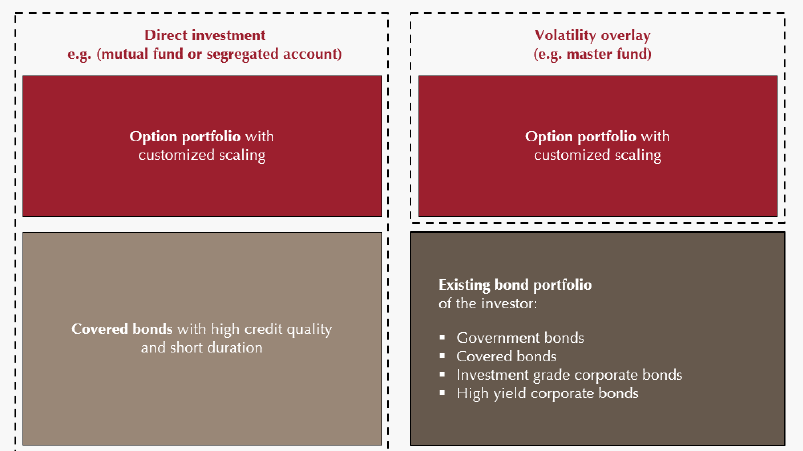

Volatility strategies can be used as an instrument for this purpose, as they capture an alternative risk premium and thus offer greater independence from the equity and bond markets. Bond investors can benefit from these additional, diversifying returns via a derivative overlay solution – without having to forgo the existing bond holdings in their asset allocation.

In contrast to a direct investment (e.g. in a segregated account or mutual fund), an overlay solution offers the possibility to work with a reduced cash deployment and to use the bonds already in the investor’s portfolio as collateral for the derivatives used. Investors can concentrate fully on managing their fixed income portfolios, while the volatility overlay is taken care of by a manager specialised on volatility strategies.

The possibility to customise scaling of the derivative portfolio also makes it possible to adapt the risk-return profile of the volatility strategy to the investor's requirements in a targeted manner. Various scalings are possible: from defensive additional returns at relatively low risk to equity-like profiles at higher risk. As a result, capturing the volatility risk premium enables an improved return/risk profile of the overall portfolio – without requiring any significant deviations from the existing allocation.

Mark

Ritter

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

Multi-asset strategies in trouble: Value protection as an attractive alternative

Following the massive pressure that multi-asset strategies experienced in the wake of interest rate hikes two years ago, the outlook seemed to have brightened significantly again at the beginning of this year. In anticipation of a turnaround in interest rates during the course of this year, many investors once again turned to the use of mixed portfolios of equities and bonds.

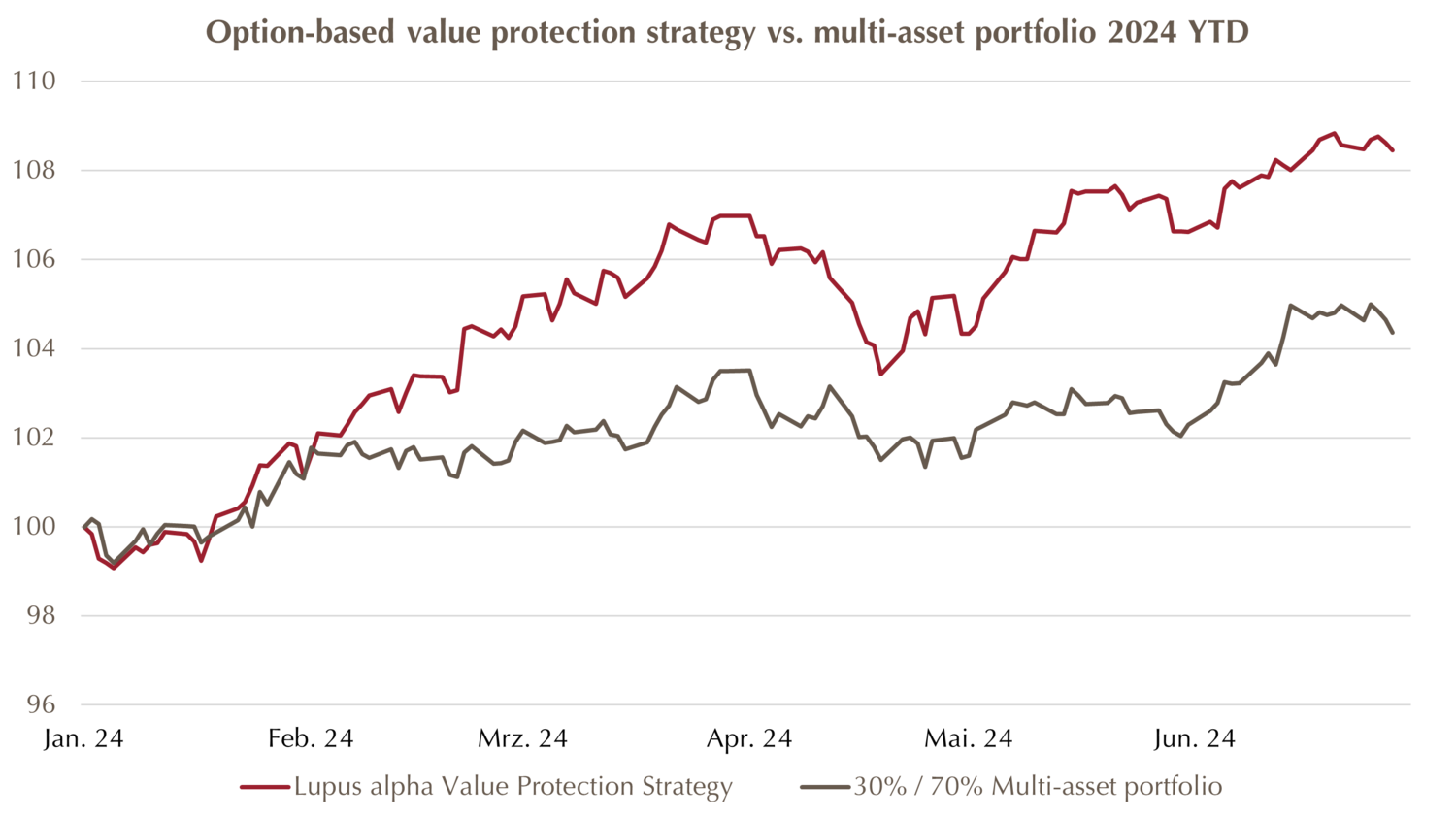

However, these hopes have not been fulfilled so far, given that interest rate cuts in the U.S. were postponed repeatedly and the first interest rate hike by the ECB was rather tentative. Accordingly, the performance year-to-date shows that the challenges for multi-asset approaches continue. Once again, investors are facing underperformance despite a strong performance of equity markets. This is mainly attributable to the weak performance of the bond component which suffers from the often high duration risks associated with those strategies. Investors with a limited risk budget should therefore consider alternatives.

An example of more defensive investment strategies that do not suffer from such high duration risks and even benefit from the current market environment are option-based equity value protection strategies. Unlike traditional mixed funds, they do not rely on interest rate cuts for performance but even benefit from the increased interest income through their underlying basis portfolio. This usually consists of high quality, short-term bonds so that duration risks are negligible.

Furthermore, they can take advantage of the current low equity volatility (see alpha insights Q1/2024) which traditional multi-asset concepts rarely (can) make use of. This enables option-based strategies to offer even more attractive return opportunities while preserving an effective downside hedge. In an uncertain market environment, these strategies are therefore a compelling alternative for investors who wish to combine capital preservation and return potential – and are willing to move beyond traditional concepts.

Stephan

Steiger

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

FX overlays are not a source for alpha

When currency markets experience turbulence, it is usually not the major international reserve currencies that dominate the headlines. For some time now, however, this has been exactly the case with the Japanese yen. Disappointed by the Bank of Japan’s (BOJ) refusal to adjust key interest rates to economic realities, the yen is now falling from one low to the next and even central bank market interventions seemed to miss their target.

Such eye-catching movements often cause investors to question their existing hedges against possible exchange rate effects on their portfolio. In the context of asset-liability-management, we regularly hear about concepts that promise to generate alpha from the FX overlay in addition to risk management. But is this realistic? We are sceptical for the following reasons:

For long-term excess returns market inefficiencies are required. However, these are unlikely to be existent in major currency pairs, as a large number of professional traders are active in this market – from central banks to hedge funds. Moreover, compared to other asset classes, it is not readily apparent which market participants hold the long or short position: On the one hand, by definition, this cannot be determined in a currency pair; on the other hand, much of the transaction and inventory data are not publicly available.

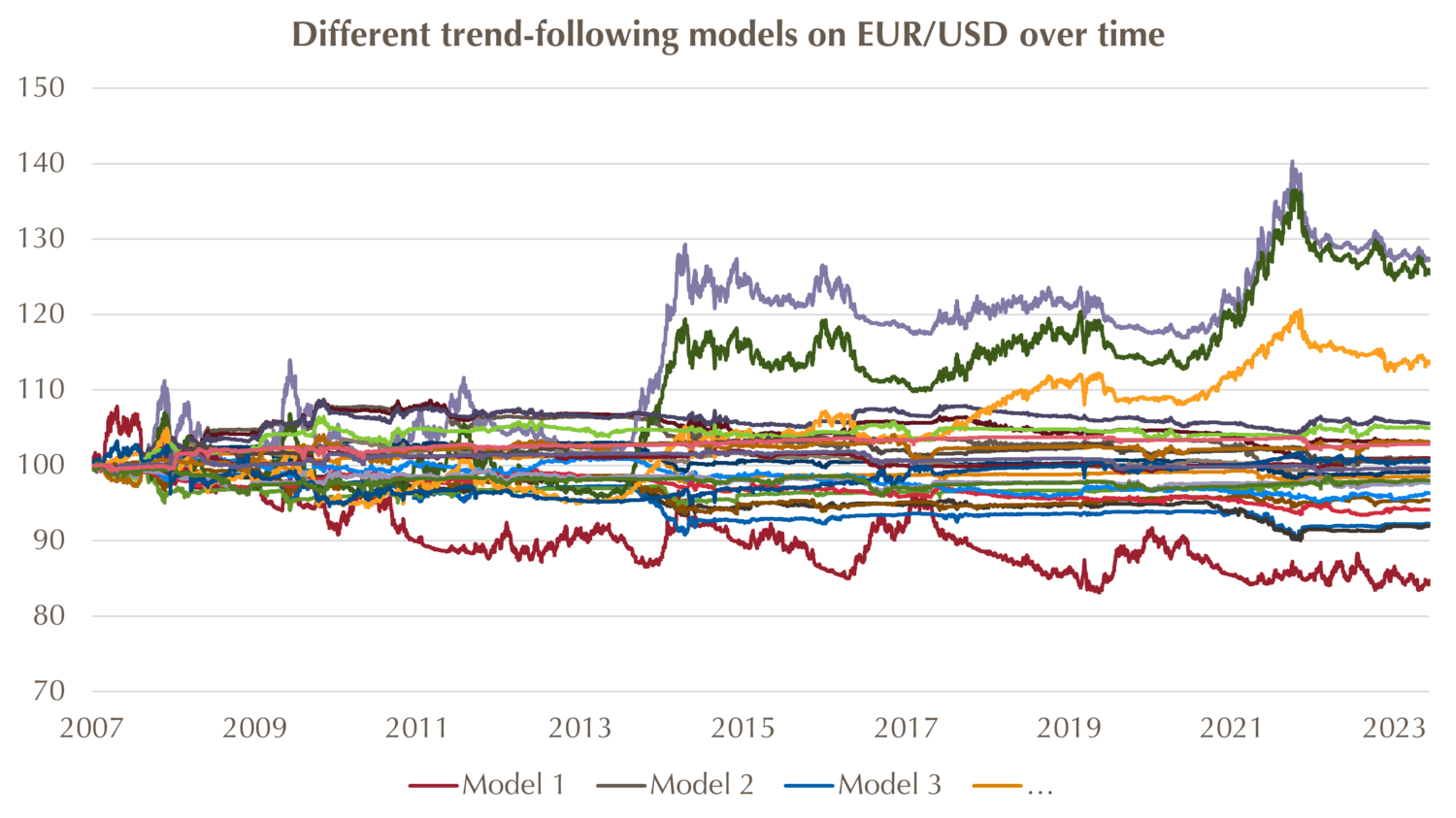

Many FX overlays are ultimately based on the idea of momentum or trend following. These models, however, are not robust in the markets under consideration. Backtests can be used to find models that would have worked in the past, but reality often turns out to be different. The chart below illustrates this with various trend following models for EUR/USD. Some seem to work, but many do not – which is probably no more than a coincidence.

So, while it makes sense to manage currency risks, one should not give in to the temptation of generating additional income from an FX overlay.

Marvin

Labod

Head of Quantitative Analysis

Alexander

Raviol

Partner, CIO Derivative Solutions