Topics and markets Q3/2024

Trust is good, control is better!

![[Translate to English:] Dr._Goetz_Albert](/fileadmin/_processed_/9/e/csm_Dr._Goetz_Albert_1_b75c5b90f5.jpg)

August 5th, with its brief massive drawdowns, painfully reminded investors of the risk of sharp losses. While investors had been able to enjoy a fairly calm year on the capital markets until then, this turbulence once again highlighted the relevance of effective risk management.

The widely anticipated market fluctuations in the run-up to the US presidential election have also yet to materialize. However, this could change as election day approaches and economic consequences might be underway after the election. In this situation, broad portfolio diversification across all asset classes combined with efficient risk management instruments remains the first class.

Yours

Dr. Götz Albert, CFA

Partner and Chief Investment Officer

German small and mid caps are more internationally oriented than one might think

The German economy has not been able to escape the negative headlines since the outbreak of the war in Ukraine. While the news was initially dominated by the rise in energy as well as production costs and the strong dependence on China, the difficulties are now becoming more concrete with the proposed plant closures by Volkswagen.

However, the German stock market indices reflect this development in very different ways: while the DAX reached new record highs, the weakness of the German economy was particularly evident in the smaller stocks and especially in the MDAX which is still trading below its pre-Covid level. This is often attributed to the greater dependence of these companies on the domestic market. But is this dependence really that pronounced?

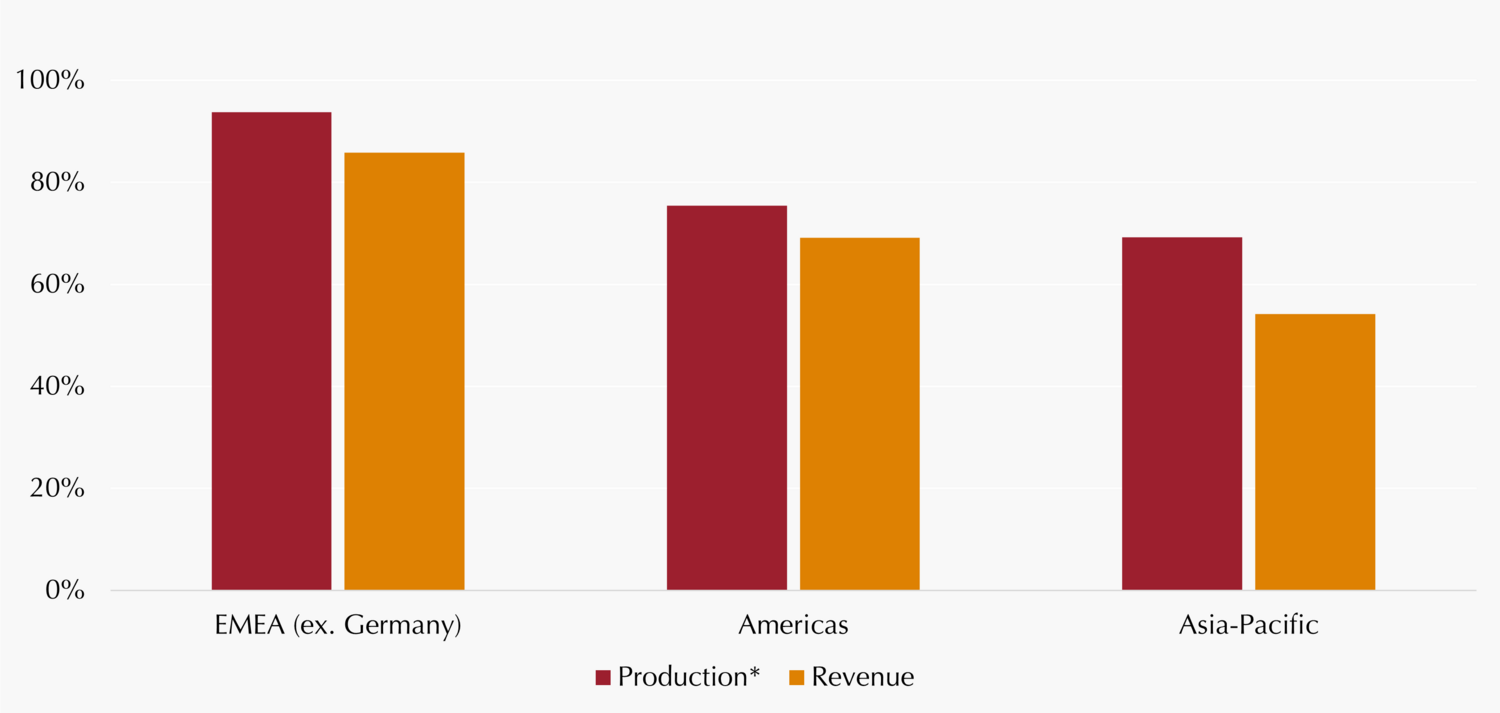

A look at the revenues of small- and mid-cap stocks reveals a surprisingly international picture: MDAX companies, for example, generate over 65% of their income outside Germany. Doing so, they are not only relying on their European neighbors, but also generate a significant proportion of their revenues (around one third) in North/South America and Asia-Pacific. A similar pattern can be observed for SDAX companies, however, with sales to European countries playing a somewhat larger role. The dependency on growth in the domestic market is therefore significantly lower than in the U.S., where Russell 2000 companies often generate over 80% of their revenues in their home market.

On the production side, German small and mid caps are also much more globally positioned than is generally assumed. Most manufacturing companies have production sites on several continents: 75% of companies operate production sites in the Americas and around 70% in the Asia-Pacific region. In view of increasingly protectionist trade practices, these are an important success factor. Therefore, the supposedly high dependence of German small- and medium-sized enterprises on their domestic market should be viewed in a more nuanced way – in particular, as it relates to public equities.

Björn

Glück

CFA, Partner, Portfolio Management Small & Mid Caps Europe

Jonas

Liegl

CFA, Portfolio Management Small & Mid Caps Europa

Hedge funds are back as key player in the convertible bond market

While the convertible bond market has historically always offered an interesting playing field for hedge funds, this market has been dominated by long-only investors in recent years. Since 2020, however, arbitrage investors have increasingly returned to that segment. Bank of America even estimates that such investors now account for more than half of the convertibles segment – the highest level since 2007.

Convertible arbitrage strategies aim to profit from mispricings by taking long or short positions in the convertible bonds’ components. To achieve attractive returns, they rely primarily on the use of leverage. However, the conditions in the aftermath of the financial crisis were quite unfavorable in this regard: banks became much more cautious in their lending practices and increased their margin requirements for hedge funds. At the same time, interest rates fell to historical lows, so that the bond component offered hardly any income. Moreover, markets were also characterized by relatively low volatility.

Since 2020, the market environment has clearly turned back in favor of arbitrage strategies: volatility rose significantly in the wake of the Covid pandemic and higher inflation rates led to interest rate hikes after a decade of zero (and even negative) yields. In addition, there was a noticeable increase in new issuances (as discussed in earlier reports), resulting in significant price discounts that investors in the primary market can take advantage of.

What consequences does the increase in those strategies have for the convertibles market and the long-only investors active in it? On the one hand, this means a larger degree of competition in the primary market as the increased number of hedge funds reduce the allocations per investor. On the other hand, they provide more liquidity to the market – especially in securities with an equity-like profile (“in the money”), which tend to be avoided by investors primarily interested in the convex profiles of convertible bonds. It therefore remains to be seen whether the net effects will ultimately be positive or negative.

Marc-Alexander

Knieß

Portfolio Management Global Convertible Bonds

Stefan

Schauer

Portfolio Management Global Convertible Bonds

Manuel

Zell

CESGA, Portfolio Management Global Convertible Bonds

It’s the net returns that matter

The first interest rate cut by the US Federal Reserve had long been expected in the bond markets. However, not all market participants had expected the relatively large rate cut of 50 basis points, since inflation and labor market data sent mixed signals. Although only a minority of market participants still expect a hard landing for the economy, their share has risen significantly compared to previous surveys.

The outcome of the possible economic scenarios has a significant impact on the expected yields in the individual segments of the bond market: the higher the default rates, the greater the difference between gross and net yields – particularly in the lower rating segments. In the EUR High Yield (HY) segment, for example, default rates have averaged around 2,6%1 over the last 20 years, however with notable annual deviations ranging from less than 0.5% per year in the best case to more than 10% in the worst case.

If default rates in the HY segment were to rise slightly above the long-term average in the coming months – as expected by S&P2 – the difference in expected net yields between investment grade and high yield bonds will narrow to less than one percentage point. This aspect becomes even clearer in comparison with EUR CLO tranches with an investment grade rating, which have historically never defaulted3: here the gross yield of around 5% corresponds to the expected net yield which means significantly higher returns than in the HY bond segment.

In view of the macroeconomic outlook, investors should carefully consider whether potential price gains from falling interest rates justify the risks in the traditional corporate bond segment. While IG CLOs do not offer such price potential, investors can sit back and collect the coupon payments regardless of an economic downturn.

1 Based on analyses of data since 2005 from Bank of America; as of: July 2024.

2 S&P Global: Default, Transition, and Recovery: The European Speculative-Grade Default Rate Will Level Out At 4.25% By June 2025. As of: 22.08.2024.

3 Referring to EUR CLOs 2.0 which were issued after the financial crisis and are equipped with a much stronger security structure due to reformed regulations on such products.

Dr.

Klaus

Ripper

Portfolio Management Fixed Income Credit

Norbert

Adam

Portfolio Management Fixed Income Credit

Well-positioned volatility strategies were able to weather the storm on August 5th

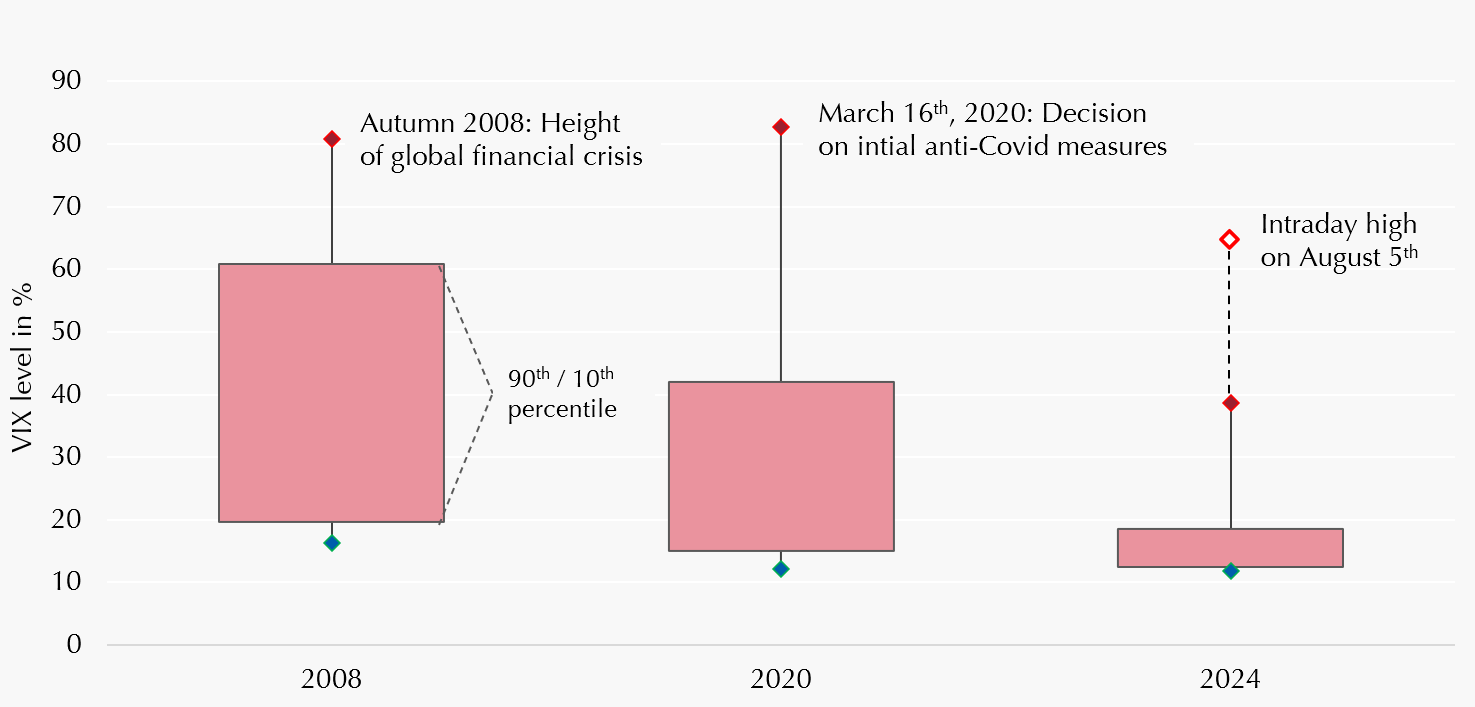

On this day, Japanese equities recorded their sharpest fall since 1987, with a loss of -12.4% in the Nikkei 225 and -17.3% in the Topix banking index. A large number of market participants unwound their yen-based carry trades, in which investors borrowed in the low-yielding yen in order to invest in higher-yielding instruments outside Japan. This further exacerbated the downward trend. Combined with illiquid trading hours in Asia and seasonally lower liquidity in August, this led to a sharp rise in implied volatility, which catapulted the VIX to a (pre-market) intraday high of 65.7% – the third highest level since the 2008 and 2020 crises.

For investors in short volatility strategies, this situation initially appears to be the feared “insurance case” with the threat of correspondingly high losses. On the contrary, however, this event has proven once again that volatility strategies with effective risk management, such as those offered by Lupus alpha, are able to limit losses during periods of stress by using tail hedges.

Hedging instruments such as VIX calls (which are specifically themed on abrupt volatility peaks) as well as regular intraday delta hedging have enabled the limitation of considerable losses. In addition, the flexible management of option maturities enables a broader diversification of the portfolio and provides the opportunity to make use of short-term volatility spikes by selling options at such higher levels. This approach, combined with robust tail risk hedging, gives the portfolio resilience to extreme events.

After just eight trading days, this approach enabled Lupus alpha's volatility strategy to fully offset the losses and even reach a new all-time high in the same month despite the dramatic market turmoil.

Distribution of daily VIX index levels in 2008, 2020 and 2024

Explanatory note: 80% of the daily VIX index values fall within the red-shaded area. For example in 2008, the VIX closed above a level of 61 (90th percentile) on 26 trading days (corresponds to ~10% of trading days). Source: Bloomberg, own calcluation and illustration. As of: 04.10.2024. Past performance is not a reliable indicator for future performance.

Mark

Ritter

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

Stress test in August successfully passed

The stock market turbulence at the beginning of August was accompanied not only by a sharp rise in volatility (see “Volatility strategies”) but also by heavy temporary drawdowns. The Japanese Nikkei, which suffered from the increased unwinding of yen-based carry trades, fell by -20% within only three trading days, and the global equity market also suffered losses of -7% at the start of the month.

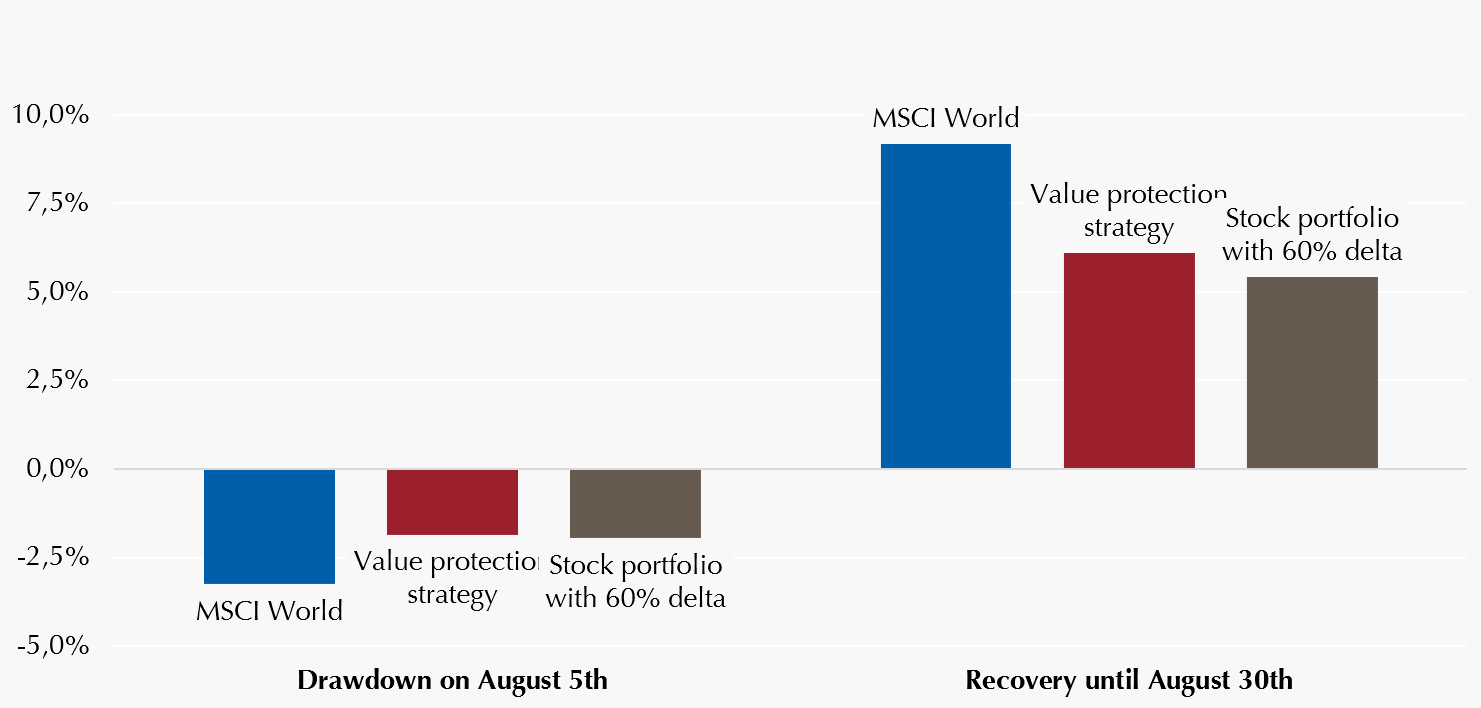

After a positive year up to that point, equities experienced significant losses for the first time which also put value protection concepts to their first test in 2024. Thanks to the friendly start into the year for equities, low equity volatility and relatively high interest on the underlying bond portfolio, such strategies were able to enter into a high equity market delta and accordingly participated strongly in the performance (YTD participation of around 60%). Due to the positive equity performance, many option-based strategies also moved relatively far away from their respective lower value limit for the calendar year, providing them more risk capital and a higher delta. In consequence, these strategies also participated correspondingly strongly in the downward movement: While the MSCI World hedged to EUR suffered a daily loss of -3.3% on August 5th, value protection strategies suffered losses of -1.9%.

Nevertheless, these strategies passed the test with flying colors: actively managed, option-based capital protection strategies were not only able to significantly limit the losses but were also able to participate significantly in the subsequent recovery rally (see chart). This clearly distinguishes them from a hypothetical portfolio with a static equity delta, which had only recovered by a good 5% by the end of August, while option-based strategies were able to gain more than 6% – which corresponded to around 67% of the 9.2% performance on the global equity market. Value protection strategies were thus once again able to demonstrate the added value of asymmetric payout profiles.

Performance during the market turmoil and subsequent recovery in August 2024

Data based on MSCI World 100% Hedged to EUR Index, Lupus alpha Value Protection Strategy and a hypothetical 60% MSCI World portfolio. Source: Bloomberg, own calculation and illustration. As of: 30.09.2024. Past performance is not a reliable indicator for future performance.

Stephan

Steiger

CFA, CAIA, Portfolio Management Derivative Solutions

Alexander

Raviol

Partner, CIO Derivative Solutions

Building a tail hedge against black swans – but the right way!

After the unexpected price drop in early August, investors are once again thinking more about hedging their portfolios against Black Swan events – whether due to risk aversion or regulatory requirements. To achieve this, risk-conscious investors typically rely on broad portfolio diversification across various asset classes. While this setup serves as a cost-effective tool for reducing risk in normal market conditions with moderate price fluctuations, these approaches reach their limits during severe market disruptions.

The reason lies in the sharply increasing correlations between different asset classes during extreme stress phases. For example, during the financial crisis, this led to portfolio drawdowns of around 35% despite having a 40% bond component. Therefore, those seeking to protect themselves from major market turbulence need more than just a well-diversified asset allocation.

A look at the statistics shows that such stress phases are by no means rare: Over the past 20 years, a mixed portfolio consisting of 60% stocks and 40% bonds displayed negative deviations of more than 3 standard deviations from the average daily return on more than 1% of trading days (see chart below). What may initially seem like a small figure proves to be significant when compared to a normal distribution: If daily returns followed such a distribution, there would be only about 0.3% of trading days with such downward outliers.

There is a wide range of options available for mitigating such tail risks, but not all instruments are suitable from an efficiency perspective. Hedging with far out-of-the-money put options on the relevant underlying assets does provide adequate protection against losses but is relatively expensive. Instead, one can take advantage of the correlation characteristics in capital markets during crisis phases: In turbulent market phases, not only do the prices of stocks, bonds, etc., tend to drop, but market volatility also increases sharply. By using calls on volatility indices like the VIX for U.S. markets, investors can build effective hedging positions at a relatively low cost.

Distribution of a 60% stock / 40% bond portfolio’s daily returns

Distribution of daily returns for a portfolio consisting of 60% exposure to MSCI World 100% Hedged to EUR and 40% EUR IG Corporate Bonds since 2002. Source: Bloomberg, own calculations. As of: 31.08.2024. Past performance is not a reliable indicator for future performance.

Marvin

Labod

Head of Quantitative Analysis

Alexander

Raviol

Partner, CIO Derivative Solutions